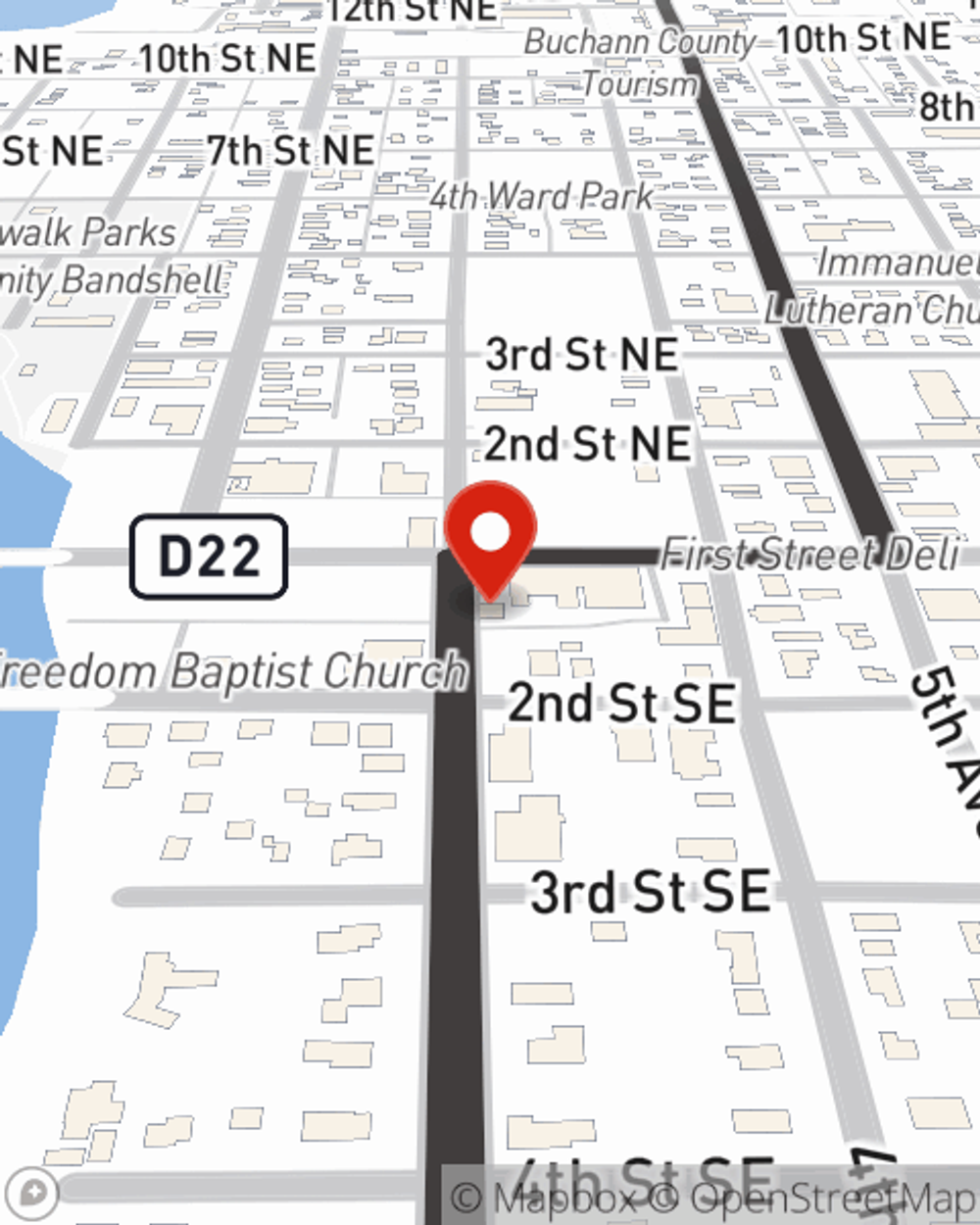

Business Insurance in and around Independence

Independence! Look no further for small business insurance.

No funny business here

- Independence

- Manchester

- Winthrop

- Quasqueton

- Walker

- Center Point

- Rowley

- Brandon

- La Porte City

- Raymond

- Hudson

- Gilbertville

- Denver

- Dunkerton

- Jesup

- Urbana

- Alburnett

- Troy Mills

- Evansdale

Coverage With State Farm Can Help Your Small Business.

As a small business owner, you understand that running a business can be risky. Unfortunately, sometimes mishaps like a customer stumbling and falling can happen on your business's property.

Independence! Look no further for small business insurance.

No funny business here

Cover Your Business Assets

With State Farm small business insurance, you can give yourself more protection! State Farm agent Tim Reed is ready to help you handle the unexpected with dependable coverage for all your business insurance needs. Such attentive service is what sets State Farm apart from other business insurance providers. And it won’t stop once your policy is signed. If you have problems at your business, Tim Reed can help you file your claim. Keep your business protected and growing strong with State Farm!

Do what's right for your business, your employees, and your customers by calling or emailing State Farm agent Tim Reed today to research your business insurance options!

Simple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Tim Reed

State Farm® Insurance AgentSimple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.